Should public authorities be entitled to higher interest when claiming clean-up costs under the Pollution Control Act?

What happens if a vessel has an accident involving oil spill and public authorities clean up, but wait almost three years before claiming the clean-up costs from the shipowner? Can the public authorities claim interest, and if so, from when and at what rate?

Lesetid 6 minutter

In December 2019 the Ministry of Transport issued a white paper proposing a statutory “deprivation” interest rate of NIBOR + 4% per annum on all clean-up response costs to apply from the time when the relevant costs were incurred until the time when interest for late payment starts accruing, which is normally 30 days after a written demand for payment. This would represent a significant increase compared to the current rate applied by the courts.

Clean-up response actions under the Pollution Control Act 1981 (the “Pollution Act”) arise in the context of groundings, collisions, sinkings or other accidents and are often initiated as a precautionary measure.

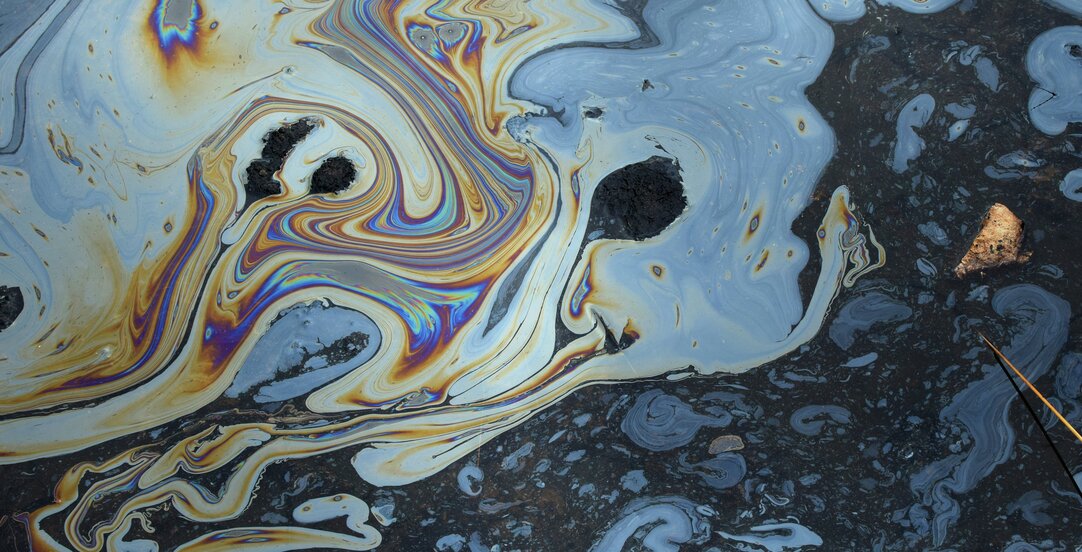

There have unfortunately been several accidents along the Norwegian coast resulting in vessels causing large oil spills and other types of pollution. Examples are the “Server” off Fedje in 2007 and “Full City” off Såsteinen in 2009. Both resulted in bunker oil spills and the Norwegian public authorities immediately initiated state led clean-up operations. Pursuant to section 76 of the Pollution Act, public authorities may claim clean-up costs incurred from the person responsible for the pollution. In both the examples mentioned above these costs were significant, but the public authorities delayed presenting a quantified claim to the shipowner for a significant period of time after the costs were incurred.

The Ministry’s proposal to codify deprivation interest

Currently public authorities can claim 2.5% interest on clean-up costs from the date they were incurred up until 30 days after a demand for payment has been presented to the liable party. This type of interest is sometimes referred to as “deprivation” interest, since the purpose is to compensate for the creditor’s loss caused by having been deprived of the relevant amount. From 30 days after a demand for payment, statutory penalty interest is payable – currently at 9.5% per annum) until payment is received.

In the “Full City” case the public authorities were awarded deprivation interest based on the principles established through case law. Although the public authorities claimed an interest rate of NIBOR (3 months) + 4% per annum, being the rate now proposed in the white paper, the Court of Appeal held that the interest rate should reflect the public authorities’ actual loss of interest. Therefore in that case, the Court of Appeal concluded that, as the public authorities had not proven their actual interest loss, deprivation interest would be calculated on the basis of an assumed – standard – loss, which in accordance with case law would be the average commercial interest rate for bank deposits. On this basis, the shipowner argued in the “Full City” case that the interest rate should be 2.5%, which the Court of Appeal affirmed.

In its white paper, the “Full City” case is used as an example by the Ministry of Transport for why it is necessary to codify the rate of applicable deprivation interest in the Pollution Control Act section 76 so as to allow the public authorities to claim a much higher deprivation interest rate, proposed to be NIBOR + 4% per annum, until the penalty interest starts to accrue. The Ministry’s reasoning is essentially based on two arguments: (i) the high deprivation interest rate would encourage the shipowner to make early payments to the public authorities and (ii) the public authorities would normally obtain a higher commercial interest rate for bank deposits. We will not analyse the Ministry’s reasoning in detail, but simply point out some potential issues with the proposal.

Potential issues with the Ministry’s proposal

First, the higher interest rate proposed is based, amongst other things, on an assumption that the shipowner would otherwise profit during the period the public authorities are kept out of pocket. It is stated in the proposal that the codification of a higher applicable rate would strip the shipowner of this potential benefit in delaying payment to public authorities. However, this reasoning does not reflect the reality as the shipowner’s P&I club will ultimately cover the liability to the public authority, often under compulsory insurance requirements. The proposal does not therefore take into account that P&I clubs are subject to strict financial regulations concerning, amongst other things, minimum capital reserves and limitations concerning financial investments, which do not apply to a shipowner.

Secondly, linked to the point above, it is stated in the proposal that the higher interest rate incentivises the shipowner to ensure that it meets it obligations and duties to take all necessary steps to avoid and minimise the risk of polluting waters. Although the shipowner is formally responsible for implementing measures to avoid pollution, in these types of cases the public authorities almost always implement immediate clean-up response actions and take over control of the clean-up operation from the shipowner and its P&I club. In both of the cases mentioned above it was only a matter of a few hours between the incident and the public authorities implementing the clean-up response measures, and taking over control of the operations.

Thirdly, in pollution cases where the public authorities initiate immediate clean-up actions and measures, the shipowner’s liability may exceed the relevant limit of liability under the Convention on Limitation of Liability for Maritime Claims (“LLMC”) and the Norwegian Maritime Code (“NMC”). If limitation of liability is applicable, this would normally involve the constitution of a limitation fund and limitation proceedings in accordance with chapter 12 of the NMC. When a fund has been established, the shipowner cannot make payments from the fund, as the fund is administrated by a fund administrator that provides recommendations to the court governing the fund. The proposal from the Ministry therefore raises questions as to how the deprivation interest under the Pollution Act relates to the special provisions for limitation proceedings. So for example, the Ministry does not comment upon the totality of interest charged, i.e. whether penalty interest shall accrue in addition to the deprivation interest. Furthermore, the Ministry does not comment upon whether liability for deprivation interest under the Pollution Act can be limited or falls within the scope of the NMC section 173 No. 6, which provides that a shipowner cannot limit liability for interest and legal costs. This could leave the shipowner in a position where they are unable to make payment from the funds to public authorities but face significant liability for interest on late payment, which cannot be limited.

Fourthly, it is not sufficiently clear whether the proposal would allow the public authority to claim interest in full in any event or whether the public authorities’ claim may be reduced should they be at fault in any way. So for example, in the majority of recent marine incidents involving oil spill or other pollution in Norway, it has taken the public authorities two to three years to prepare and present a quantified claim for payment to the shipowner. A higher interest rate would not encourage the public authorities to present timely claims against the shipowner, even if they are entitled to penalty interest 30 days after presentation of a claim.

In summary, on one hand, codifying the public authorities’ right to a specific rate of deprivation interest will provide more legal certainty. On the other hand it is also important to ensure that any such changes to the code should comply with both the current law established by the Supreme Court, and the practical and commercial realities, taking into account the interests of both the public authorities and the shipowner and its P&I club.