Offshore floating wind turbines and deepwater fish farms – different frameworks for success

The regulatory framework that exists within the shipping and offshore industries is long established. Whilst the existing framework effectively extends to also encompass the offshore floating wind sector in Norway, the same cannot be said for deepwater fish farms.

Lesetid 4 minutter

The general principle (which will no doubt be familiar to all readers of this publication) is that maritime assets above a certain minimum size are required to be registered in a national ship registry. By dint of being registered, the relevant asset will be required to comply with a host of national, regional and international rules and regulations, whose ultimate aim is to ensure that certain minimum standards relating to, inter alia, design, construction, classification, crewing, safe operation and pollution prevention are maintained and adhered to.

Registration of a vessel or asset in a recognised and respected flag state may therefore be regarded as a form of “quality assurance”.

In Norway, such government regulation is managed by the Norwegian Maritime Authority, which has around 12,000 vessels (both commercial and non-commercial vessels) on its books, flagged under both the Norwegian Ordinary Ship Register (NOR) and the Norwegian International Ship Register (NIS). Any vessel operating in Norwegian waters exceeding 15 meters in length as well as oil platforms and other mobile offshore units (such as drilling rigs) are required to be registered, unless already registered under a foreign flag.

Oil platforms and mobile offshore units engaged in petroleum activity on the Norwegian continental shelf are also subject to additional rules and regulations imposed by the Petroleum Safety Authority Norway (PSA).

In addition to helping to ensure that shipping and offshore activities are carried out in a safe, secure and regulated manner, vessel registration in a flag state plays an important role in the financing of maritime and offshore assets by enabling lenders to obtain security for loans into these sectors in the form of a registerable and enforceable encumbrance over the relevant asset in the form of a vessel mortgage, giving the holder of such mortgage priority over unsecured creditors.

Regulatory Framework for Offshore Floating Wind Turbines

Given the depth of the waters around Norway, fixing offshore turbines to the sea bed is not as easy as it is in other more Southerly parts of the North Sea. For that reason, in its push to develop an offshore wind industry, Norway has focused on utilising floating turbines (FTUs) and following years of development, the construction of the first floating offshore wind farm (Hywind Tampen) was commenced at Kvaerner Stord earlier this year. Electricity generated at the Hywind Tampen farm will provide renewable power for the Snorre A and B and Gullfaks A, B and C platforms.

The regulatory framework currently being applied to such FTUs is the same as that applied to other shipping and offshore assets, with FTUs being registerable as “other floating units” in the Norwegian Ordinary Ship Register in accordance with the Regulation on Registration of Other Floating Units published by the Norwegian Ministry of Industry and Ministry of Fisheries in 1994.

As a nod to the similarities such FTUs bear to other mobile offshore units and installations, overall supervisory responsibility for the regulation of such FTUs has been given to the PSA by a government decision of 17 August 2020 who has confirmed that it will be looking to develop more bespoke regulations for the offshore floating wind turbine sector in the coming months. Whilst the regulations are yet to be developed and presented, it is to be assumed that the provisions will broadly follow the principles which have been adopted and applied to mobile offshore units.

Such a development is to be welcomed, and once enacted, this will mean that all interested parties, whether they be owners, operators, lenders or insurers will have a degree of predictability and certainty as to the rules and regulations to be applied. The certainty over title and the ability to create a registerable mortgage over such FTUs will also enable the owners of such FTUs to obtain project financing more easily.

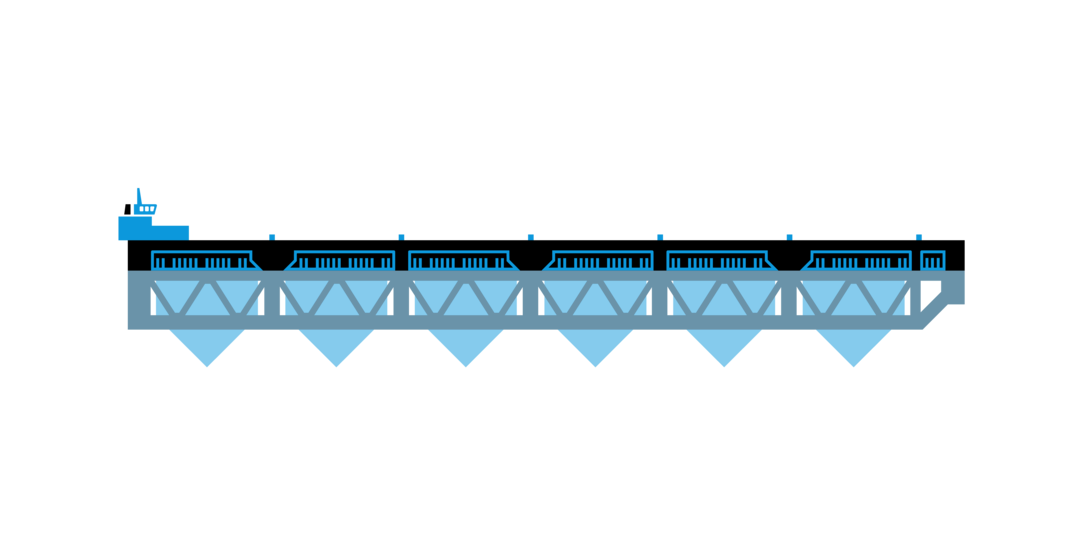

Regulatory Framework for Deepwater Fish Farms

In contrast, the regulatory framework for the construction and operation of offshore fish farms is not as developed. Indeed, it is not yet clear which government entity in Norway shall be given overall control over the development of such regulations and the authority to police their application.

As of now it is also not possible to register an offshore fish farm under the Norwegian flag.

From a financing point of view, this presents a huge obstacle to owners or potential owners of such assets with potential lenders having to rely on pledges over shares and equipment and assignments of revenue streams etc. rather than a registerable “in rem” right over the unit itself in the form of a mortgage.

We await with interest further clarification from the Norwegian government as to whether offshore fish farms will be subject to similar regulation as the shipping, offshore oil and gas and offshore wind sectors or whether a new bespoke regulatory regime will be applied and will address any future developments in subsequent publications.